florida estate tax rate

The top estate tax rate is 16 percent exemption threshold. The federal state tax has been.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Since February six property.

. Also known as estate tax or death tax the inheritance tax is the legal rate at which a state taxes the estate of someone who died owning property. Florida has a 600 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax. Florida property owners have to pay property taxes each year based on the value of their property.

Under Florida statute 19822 there is an automatic lien against Florida estates for the purposes of ensuring that estate taxes are paid. Estates of Decedents who died on or after January 1 2005. For example if you purchase a commercial property for.

Property taxes in Florida are implemented in millage rates. Florida does not have an inheritance tax so Floridas inheritance tax rate is. Floridas property-insurance market has long been troubled with private insurers dropping customers and raising rates because of financial losses.

No estate tax or inheritance tax. Florida has a sales tax rate of 6 percent. What is the Florida property tax or real estate tax.

The tax rate for commercial property in Florida is based on the value of the property and can range from 02 to 15. While observing constitutional limitations prescribed by statute the city creates tax rates. Florida real property tax rates are implemented in millage.

What is the Florida estate tax lien. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine. We are well equipped to address your estate probate asset protection and healthcare designation planning remotely through telephone and video conferencing.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Florida also has no gift taxThe federal government allows 15000 a year to be gifted to any friend relative or associate.

Property taxes apply to both. 0010 10 or 700 per. There is also an average of 105 percent local tax added onto transactions giving the state its 705.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Counties in Florida collect an average of 097 of a propertys assesed fair. As will be covered further appraising property billing and collecting payments conducting.

Further reduction in the tax. Florida estate taxes were eliminated in 2004. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

No Florida estate tax is due for decedents who died on or after January 1 2005. Florida Property Tax Rates. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

If the estate is not required to file. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold also. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022.

Florida has a 550 percent corporate income tax. Additionally counties are able to levy local taxes on top of the state. The top estate tax rate is 16 percent exemption.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Floridas general state sales tax rate is 6 with the following exceptions.

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

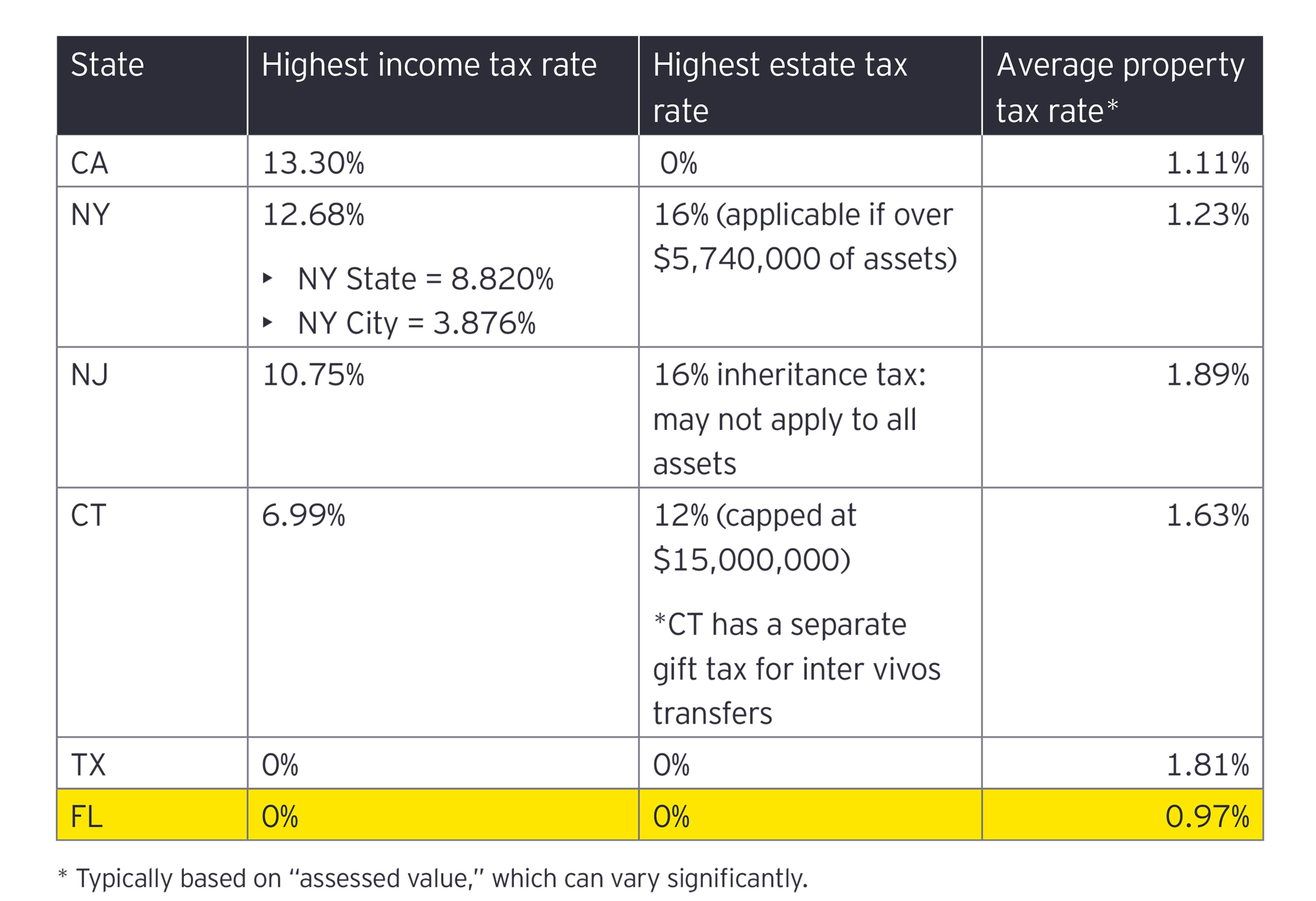

Tax Considerations When Moving To Florida Ey Us

Estate Tax Law Changes What To Do Now

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

The Estate Tax And Real Estate Eye On Housing

Tax Consideration When Venturing Your Hard Earned Money In The Us As Alien

Property Taxes By County Interactive Map Tax Foundation

Generation Skipping Trust Gst What It Is And How It Works

U S Estate Tax For Canadians Manulife Investment Management

Does Florida Have An Inheritance Tax Alper Law

Tax And Estate Law Changes Financial Harvest Wealth Advisors

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)